If you’ve been paying attention to the housing market over the past couple of years, you’ve probably noticed that sellers have had a significant upper hand. But with growing inventory, is the market beginning to shift? Let’s break down what this means for buyers and sellers in the Dallas-Fort Worth (DFW) area, including Southlake, Fort Worth, Keller, and Haslet.

What Is a Balanced Market?

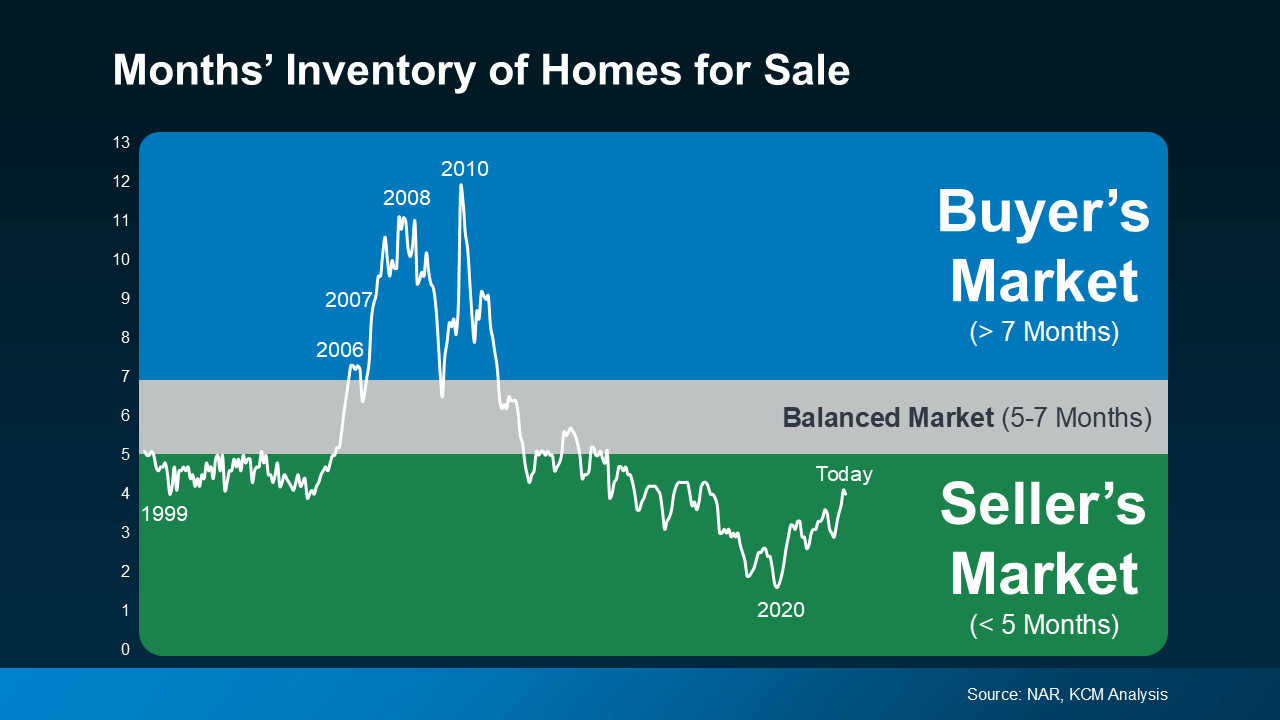

A balanced market is typically defined as a market with a five-to-seven-month supply of homes available for sale. In this scenario, neither buyers nor sellers have a distinct advantage, leading to stabilized prices and a healthier selection of homes. After years of a strong seller’s market, a move towards balance would be a welcome change for many considering a move. But are we truly headed towards a balanced market?

The Current State of Inventory

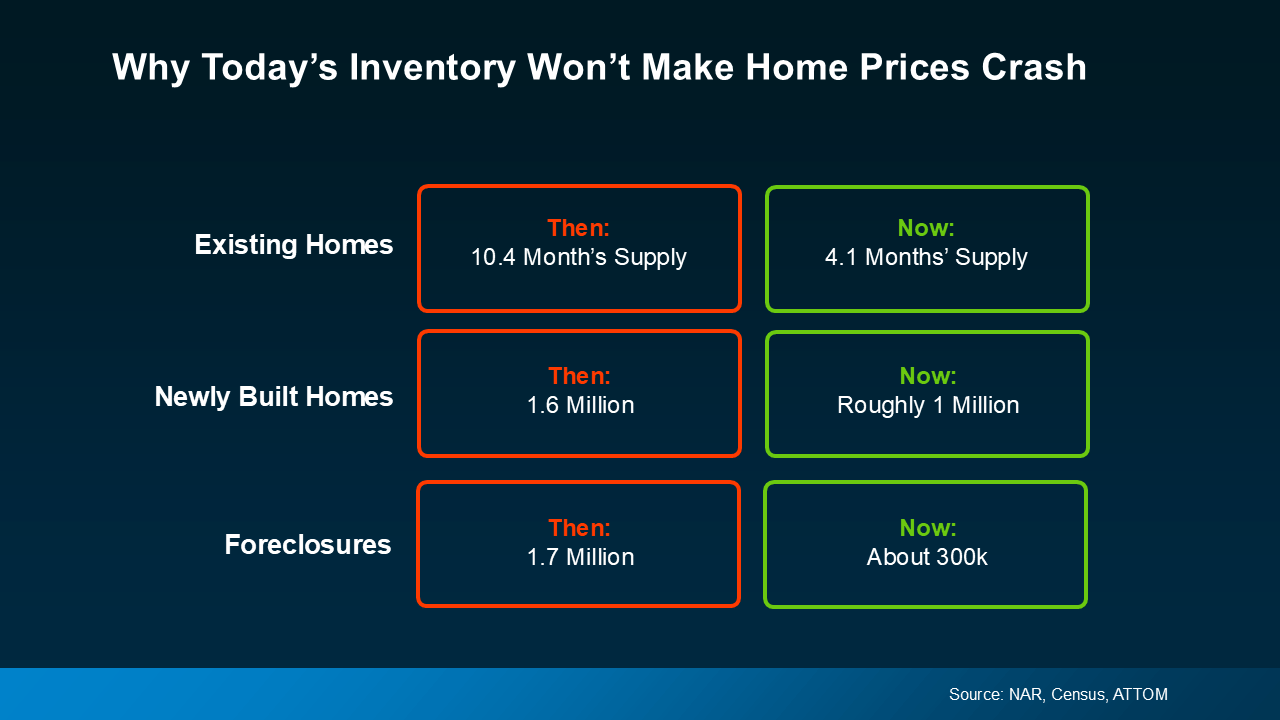

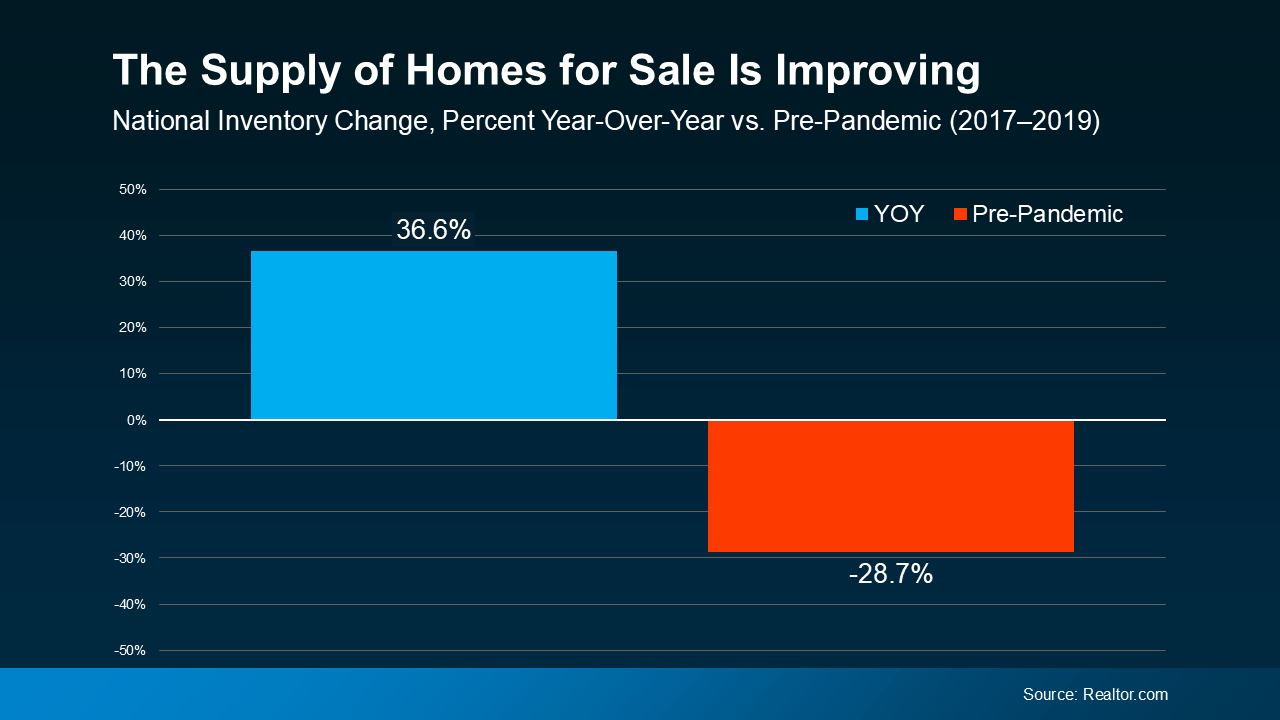

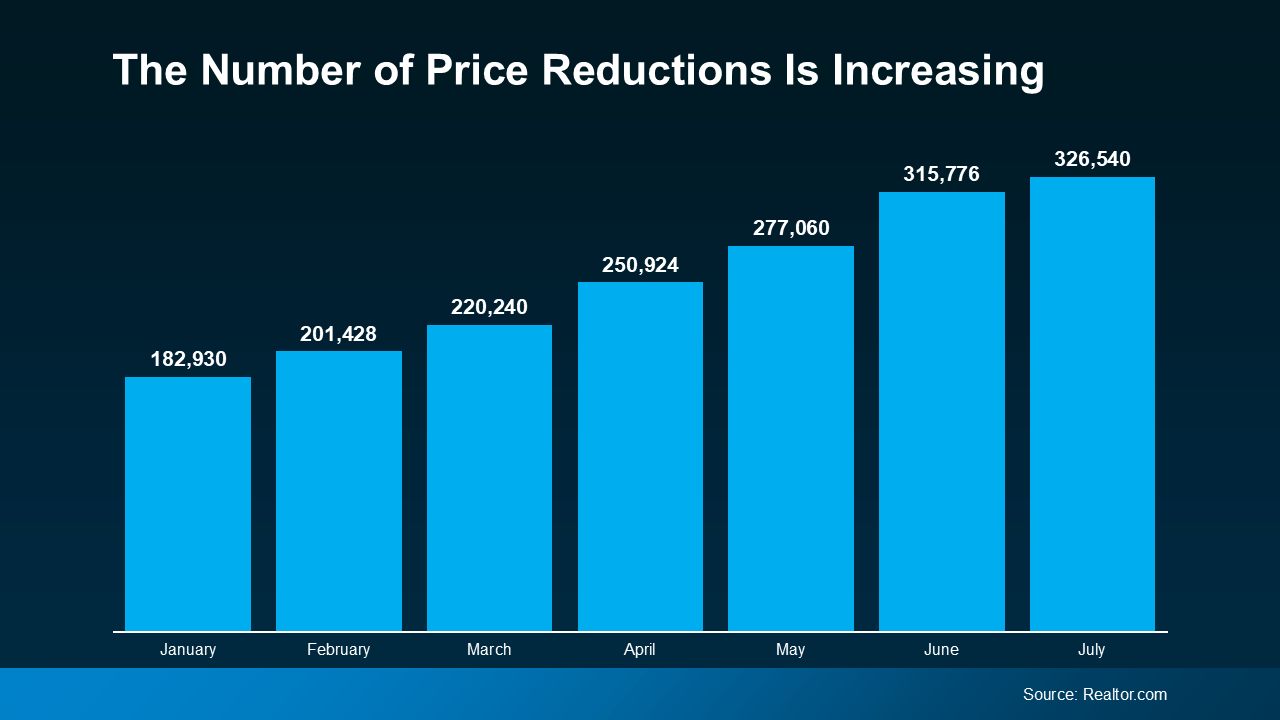

At the start of this year, the national housing inventory was at a three-month supply. That number has since grown to four months, indicating a gradual shift towards a more balanced market. While this increase may not sound like much, it’s a significant step in the right direction. However, it’s crucial to note that this growth in inventory doesn’t suggest an oversupply that could lead to a market crash. Even with the recent increases, the supply of homes is still well below what’s needed to meet current demand.

According to data from the National Association of Realtors (NAR), the market remains in seller’s territory, but it’s less intense than in previous years. As Mark Fleming, Chief Economist at First American, puts it:

“The faster housing supply increases, the more affordability improves and the strength of a seller’s market wanes.”

What This Means for You and Your Move

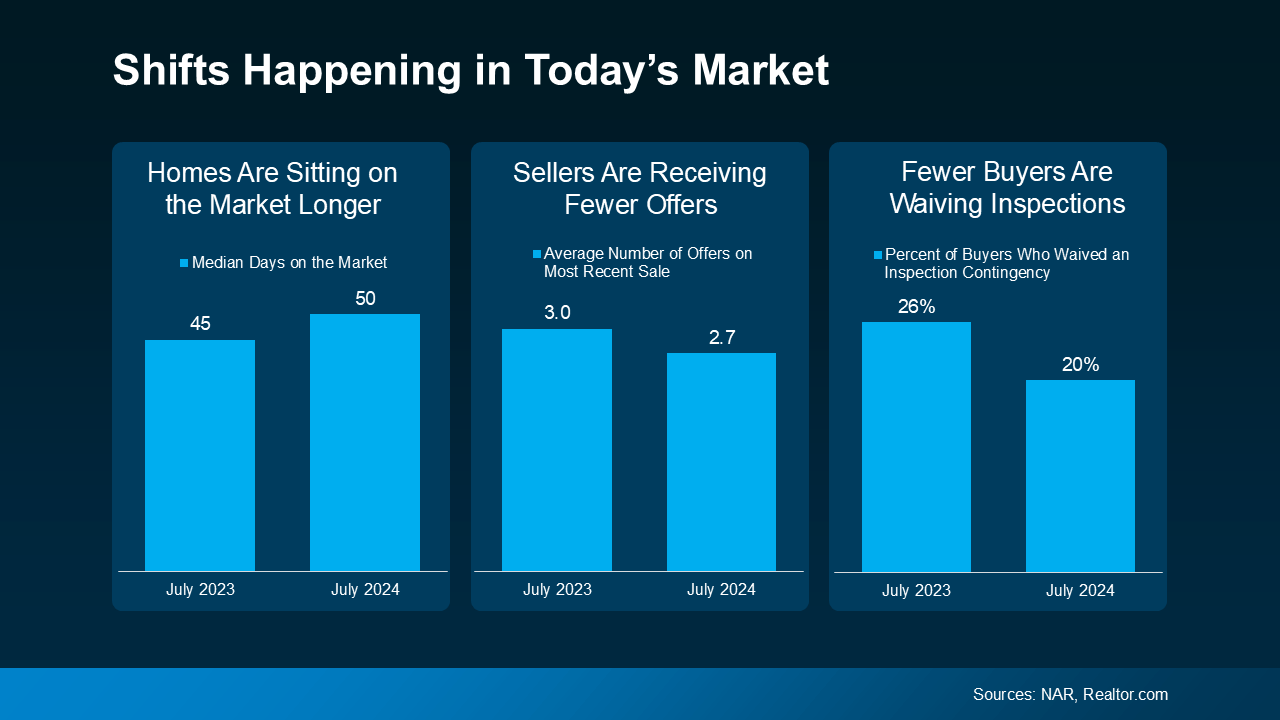

Homes Are Sitting on the Market Longer

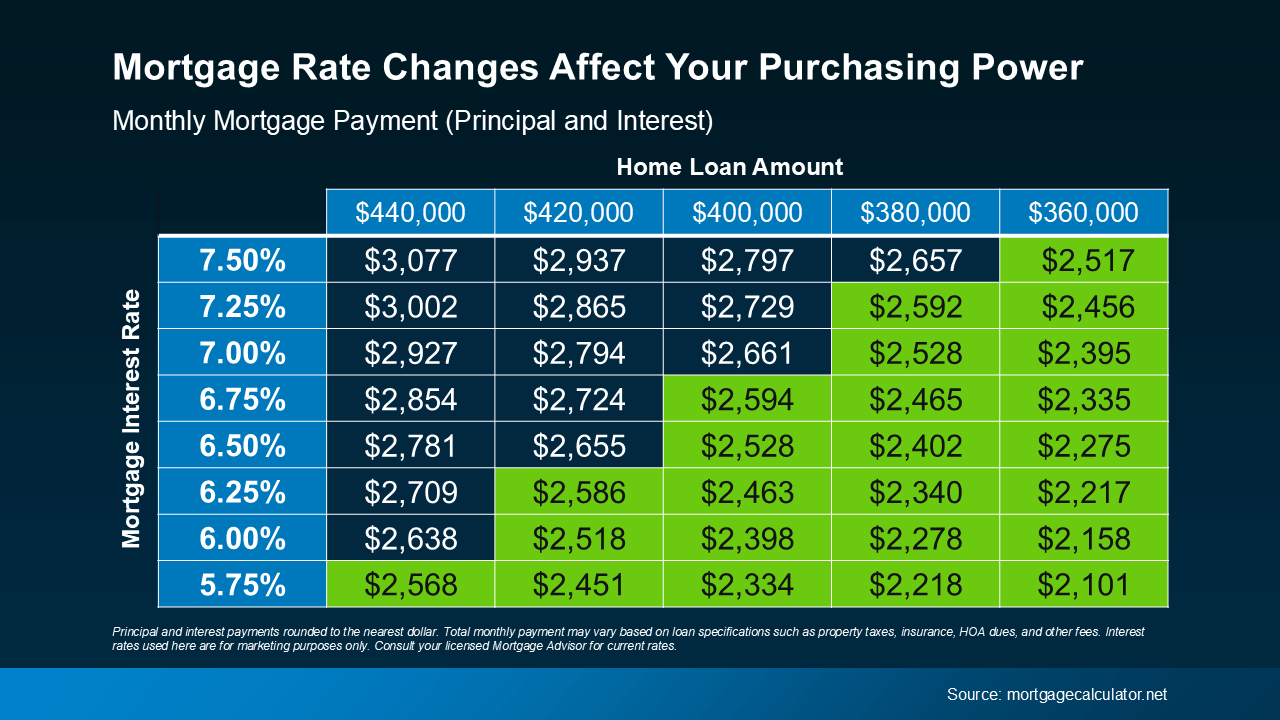

As more homes become available, they’re staying on the market a bit longer. For buyers in Southlake, Fort Worth, Keller, and Haslet, this means you may have more time to find the perfect home without the pressure of immediate decisions. For sellers, it’s more important than ever to price your home correctly. Overpricing could result in your home lingering on the market as buyers gravitate towards better-priced alternatives.

Sellers Are Receiving Fewer Offers

With increased inventory, sellers might start to see fewer offers on their properties. This means you may need to be more flexible with your pricing and terms to close the deal. For buyers, this shift could mean less competition and more room for negotiation.

Fewer Buyers Are Waiving Inspections

In a hotter market, buyers often waived inspections to make their offers more competitive. But with the market cooling slightly, more buyers are insisting on inspections, giving them greater peace of mind. For sellers, this means being prepared to negotiate and possibly address repair requests to keep the sale moving forward.

How a Real Estate Agent Can Help

While these trends provide a national perspective, the specific conditions in your local market may vary. That’s why it’s essential to work with a local real estate agent who understands the nuances of the DFW and Southlake markets. Whether you’re buying or selling, having access to the latest data and insights can give you a significant advantage.

Your agent can help you navigate these changes, ensuring you make the best decisions for your unique situation. They’ll provide you with the most current information on how the market is evolving in your area, so you can move forward with confidence.

Bottom Line

The real estate market is always shifting, and it’s essential to stay informed about these changes. Whether you’re considering buying or selling in Southlake, Fort Worth, Keller, Haslet, or other areas in the DFW Metroplex, understanding the move towards a more balanced market can help you make the best possible decisions.

If you have any questions or need expert advice, don’t hesitate to reach out. I’m here to help you navigate the current market and elevate your home buying or selling experience. Crystal Zschirnt 4wheeltor Southlake Westlake Keller Fort Worth Haslet Trophy Club Roanoke Justin Northlake Flower Mound Argyle Real Estate New Home Selling Home Buyer Best Agent Realtor House

%20(1).png)

.jpg)

.jpg)

.jpg)