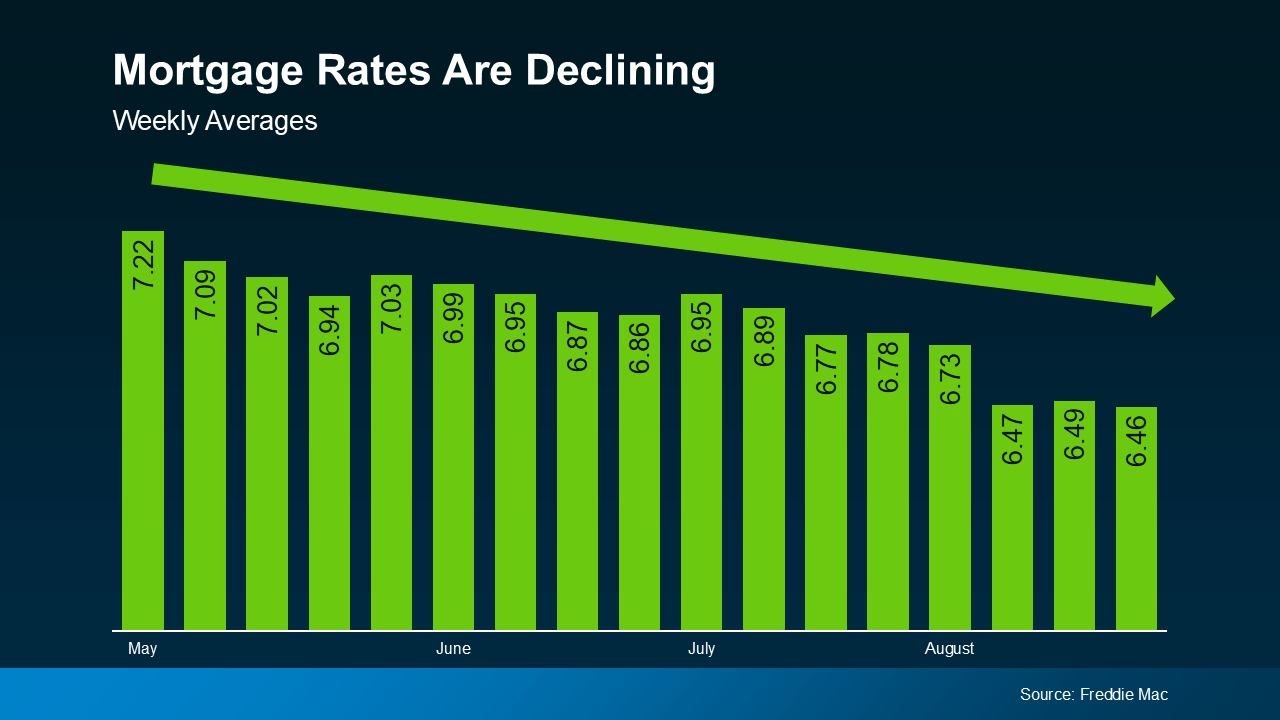

There’s no denying that mortgage rates have significantly impacted housing affordability over the past couple of years. For many prospective homebuyers in the DFW Metroplex, this has meant delaying plans to purchase a home. But there's good news on the horizon—mortgage rates have started to come down, and recently, they hit their lowest point in 2024, according to Freddie Mac.

There’s no denying that mortgage rates have significantly impacted housing affordability over the past couple of years. For many prospective homebuyers in the DFW Metroplex, this has meant delaying plans to purchase a home. But there's good news on the horizon—mortgage rates have started to come down, and recently, they hit their lowest point in 2024, according to Freddie Mac.

If you're considering buying a home in the DFW area, you may be wondering how much lower rates will go. Let’s dive into expert projections and what they mean for you.

Expert Projections for Mortgage Rates in 2024

Expert Projections for Mortgage Rates in 2024

The overall trend for mortgage rates is expected to continue downward, provided that inflation and the economy keep cooling. However, it's essential to note that there will likely be some fluctuations as new economic reports emerge.

While these short-term blips might be concerning, it’s crucial to focus on the larger trend: rates are still down roughly a full percentage point from their peak in May. The general consensus among experts is that mortgage rates could dip into the low 6% range in the coming months, depending on the economy and Federal Reserve actions.

For instance, Realtor.com has already revised its 2024 mortgage rate forecast to be more optimistic:

"Mortgage rates have been revised slightly lower as signals from the economy suggest that it will be appropriate for the Fed to begin to cut its Federal Funds rate in 2024. Our yearly mortgage rate average forecast is down to 6.7%, and we revised our year-end forecast to 6.3% from 6.5%."

This shift suggests that the opportunity for more affordable home financing is on the horizon.

Know Your Number for Mortgage Rates

So, what does this downward trend mean for your homebuying plans in the DFW area? If you’ve been waiting for rates to drop, it’s time to start thinking about when you’ll feel comfortable re-entering the market.

Consider this: what mortgage rate would make you confident enough to jump back into your home search? Is it 6.25%? 6.0%? Or perhaps you’re waiting for rates to hit 5.99%? The number you choose is personal and should align with your budget and financial goals.

Once you’ve identified your target rate, there’s no need to watch the market obsessively. Instead, connect with a trusted real estate professional who can monitor rates for you and provide timely updates. As Sam Khater, Chief Economist at Freddie Mac, notes:

"The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move."

By working with an experienced agent, you can be ready to act as soon as rates hit your target, ensuring you don't miss out on the best opportunities.

Bottom Line

If you've put your homebuying plans on hold due to higher mortgage rates, now is the time to think about the rate that would bring you back into the market. With rates already on the decline, your ideal mortgage rate may be closer than you think.

Once you’ve set your target, let’s connect. I’m here to help you navigate the current market and ensure you’re ready to make your move when the time is right. Together, we can elevate your home buying experience in the DFW Metroplex. Crystal Zschirnt 4wheeltor Southlake Westlake Keller Fort Worth Haslet Trophy Club Roanoke Justin Northlake Flower Mound Argyle Real Estate New Home Selling Home Buyer Best Agent Realtor House

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment