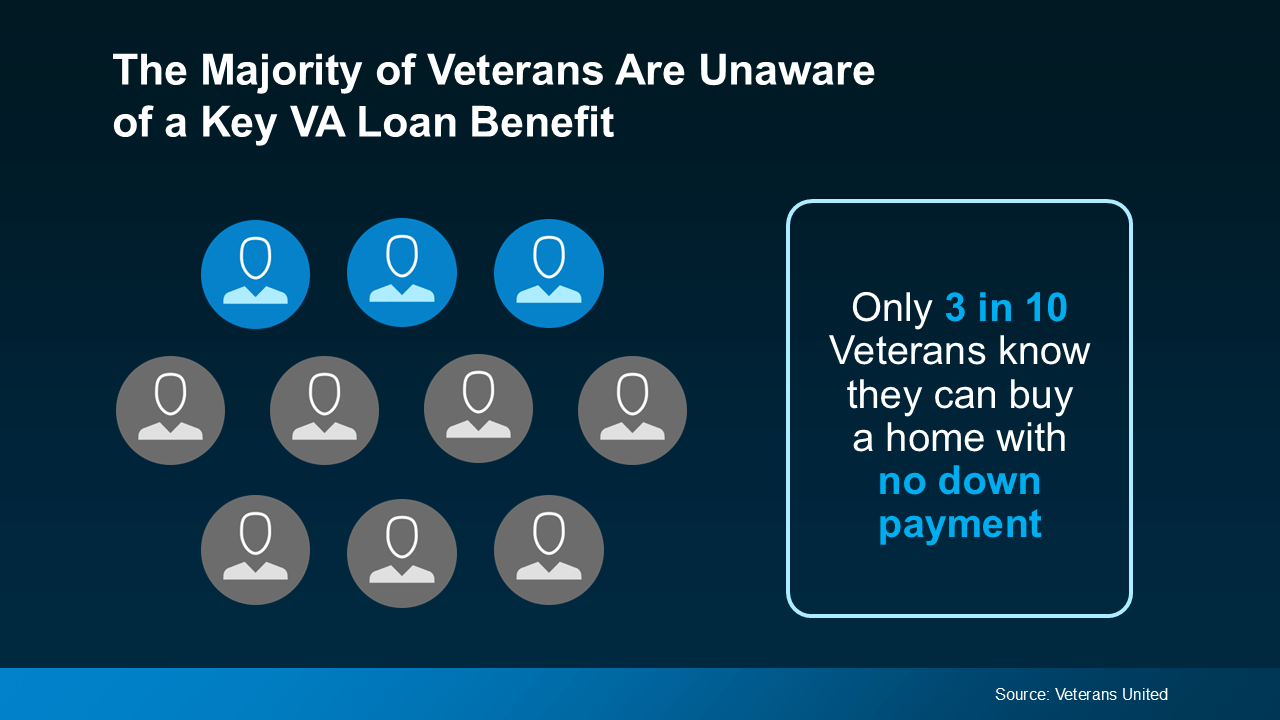

For over 79 years, VA home loans have been a cornerstone of the American Dream for Veterans, providing them with the opportunity to achieve homeownership and build generational wealth. Yet, a staggering 7 out of 10 Veterans remain unaware of one of the program’s most significant benefits: the potential to purchase a home with no down payment.

This oversight underscores the need for greater awareness about this powerful resource, which can transform the dream of owning a home into reality for so many who have served our country. Let’s dive into why VA loans are so impactful and explore the advantages that set this program apart from traditional financing options.

Why VA Loans Matter: Breaking Down the Key Benefits

VA loans are designed specifically for eligible Veterans, active-duty service members, and certain members of the National Guard and Reserves. Administered by the Department of Veterans Affairs, these loans remove many of the financial hurdles that often stand in the way of homeownership. Here’s a closer look at the standout features of VA home loans:

1. No Down Payment Required

Saving for a down payment is one of the biggest barriers to homeownership, particularly as housing costs continue to rise. With a VA loan, many Veterans can sidestep this challenge entirely.

- How it works: Unlike conventional loans, which typically require a down payment of 3-20%, VA loans allow eligible borrowers to finance 100% of the home’s purchase price.

- Why it matters: This enables Veterans to enter the housing market sooner, without needing to save tens of thousands of dollars.

As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

2. No Private Mortgage Insurance (PMI)

With most conventional loans, a down payment of less than 20% triggers the requirement for PMI, which can add hundreds of dollars to a monthly mortgage payment.

- The VA difference: VA loans eliminate the need for PMI, even with 0% down.

- The result: Lower monthly payments and more affordable homeownership over the life of the loan.

3. Limited Closing Costs

Closing costs can often be a hidden expense that catches buyers off guard. VA loans cap the types of fees Veterans can be charged, making the overall cost of closing much more manageable.

- The benefit: Veterans save money upfront, allowing them to allocate resources toward moving expenses, home improvements, or other financial priorities.

4. Competitive Interest Rates

VA loans typically offer lower interest rates compared to conventional loans, which can translate to significant savings over time.

- Why this happens: Because VA loans are partially guaranteed by the government, lenders are able to offer more favorable terms to borrowers.

Who Is Eligible for a VA Loan?

VA loans are available to:

- Veterans who meet specific service requirements.

- Active-duty service members.

- Certain members of the National Guard and Reserves.

- Surviving spouses of Veterans who died in service or as a result of a service-connected disability (under certain conditions).

Eligibility is determined by obtaining a Certificate of Eligibility (COE) from the VA. Your lender can help you secure this document as part of the application process.

What to Consider Before Using a VA Loan

While VA loans come with many advantages, there are still important factors to keep in mind:

- Loan Limits and Entitlement: While VA loans don’t technically have a maximum loan amount, lenders may impose limits based on creditworthiness and local market conditions.

- Funding Fee: Most borrowers will pay a one-time funding fee, which helps offset the cost of the VA loan program. This fee can be rolled into the loan or paid upfront, and certain borrowers (like those with service-connected disabilities) may be exempt.

- Property Standards: Homes purchased with a VA loan must meet certain minimum property requirements to ensure safety and livability.

Your real estate team can guide you through these considerations to ensure you’re fully informed and prepared.

How to Get Started

The first step in leveraging your VA loan benefits is partnering with the right team of professionals, including:

- A trusted lender: They’ll help you determine your eligibility, navigate the loan application process, and secure pre-approval.

- An experienced real estate agent: Look for someone who understands the unique needs of Veterans and has expertise in your local market.

Together, these experts will help you identify homes that fit your criteria, secure financing, and guide you through the closing process with confidence.

Why VA Loans Are More Important Than Ever

In today’s housing market, where affordability is a top concern, the benefits of VA loans are especially valuable. With the ability to purchase a home with no down payment, reduced upfront costs, and lower monthly payments, VA loans offer Veterans a pathway to homeownership that might otherwise feel out of reach.

Bottom Line

Owning a home is one of the most significant milestones in life, and VA loans are a powerful tool to help Veterans achieve that goal. If you or someone you care about has served in the military, understanding and utilizing this benefit is essential.

Let’s connect today to explore your eligibility, discuss your options, and take the first step toward making your homeownership dreams a reality. At Elite Realty Group by Redfin, we’re here to guide you every step of the way—because you’ve earned it.

Elevating all your real estate experiences. realtor, best agent, real estate, Southlake, Keller, Haslet, home buyer, home seller, home value, Trophy Club, Fort Worth, new home, house, home selling, seller tips, 4wheeltorhomes, 4wheeltor, Crystal Zschirnt, Westlake, Roanoke, Justin, Northlake, Flower Mound, Argyle, Texas

💾 𝗡𝗼𝘄 | 𝗙𝗼𝗹𝗹𝗼𝘄

𝗳𝗼𝗿 𝗠𝗼𝗿𝗲 | 𝗦𝗵𝗮𝗿𝗲

𝘁𝗵𝗲 𝗞𝗻𝗼𝘄𝗹𝗲𝗱𝗴𝗲

𝗖𝗿𝘆𝘀𝘁𝗮𝗹 𝗭𝘀𝗰𝗵𝗶𝗿𝗻𝘁 | Premier REALTOR® | 𝟴𝟭𝟳-𝟴𝟳𝟰-𝟳𝟲𝟳𝟳 | 𝗖𝗭@𝗥𝗲𝗱𝗳𝗶𝗻.𝗰𝗼𝗺

#DFWRealEstate #DFWRedfin #DFWEliteRealty #DFWHomes #4wheeltor #4wheeltorhomes

.jpg)

.jpg)

.jpg)