If you’re tuned into the real estate market, you’ve likely heard about the Federal Reserve (or the Fed) and how its decisions might impact your plans to buy or sell a home. While the Fed doesn’t directly set mortgage rates, their actions significantly influence them, especially in today’s unpredictable economic landscape.

This week, the Fed is meeting to decide on the Federal Funds Rate, the rate that banks charge each other to borrow overnight. Changes to this rate affect a wide range of financial products, including mortgages, indirectly. So, what does this mean for you? Let’s break down why the Fed’s decisions are important, what factors are influencing their choices, and what it all means for mortgage rates moving forward.

Why the Fed’s Decisions Matter to the Housing Market

The Federal Funds Rate isn’t the same as mortgage rates, but mortgage rates are influenced by it. When the Fed raises or lowers this rate, it affects the cost of borrowing throughout the economy, including mortgage rates. For buyers, sellers, and anyone with an interest in the housing market, understanding what the Fed is doing—and why—can help clarify what might happen with mortgage rates in the near future.

Three Key Economic Indicators the Fed Monitors

The Fed’s decisions are driven by a few key indicators. Here’s how each one plays a role:

1. Inflation Trends

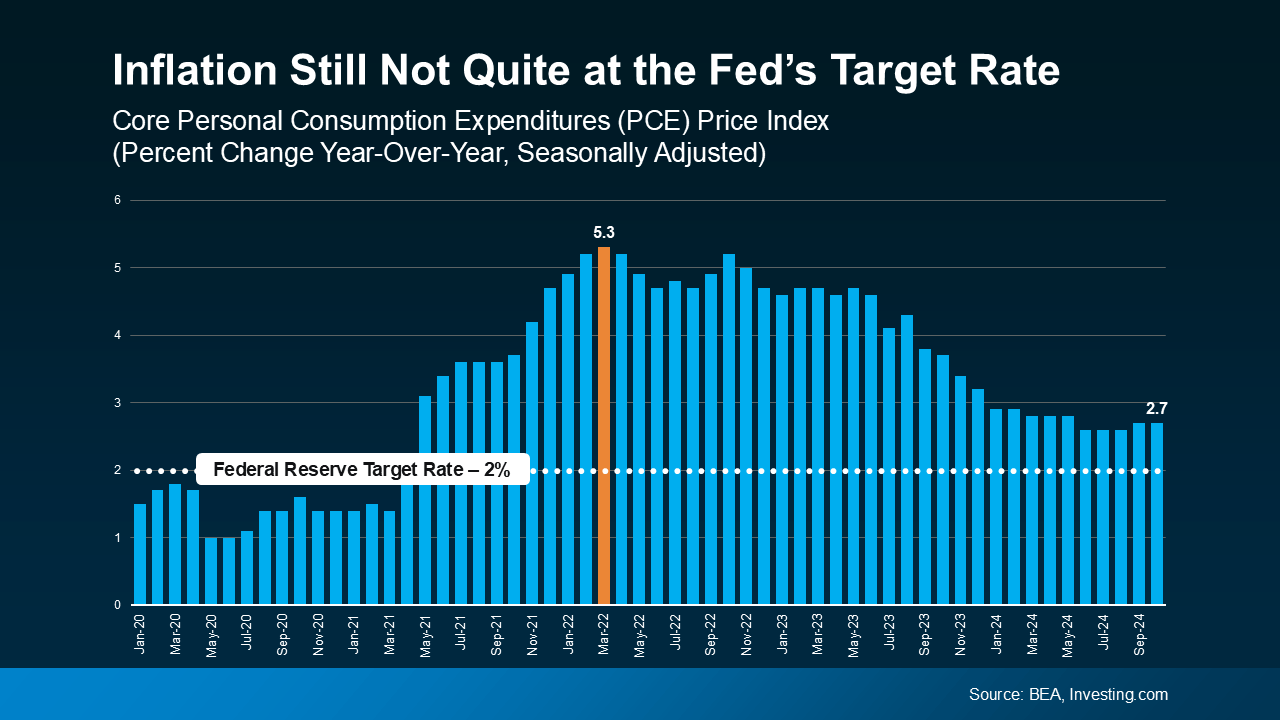

Inflation—the rate at which prices for goods and services increase—has been a hot topic for a few years now. When inflation runs too high, the Fed typically raises the Federal Funds Rate to slow down economic activity and, ultimately, bring prices back to a manageable level.

While inflation has cooled down from the peaks seen in recent years, it’s still not quite at the Fed’s target of 2%. By gradually lowering the Federal Funds Rate as inflation continues to trend downward, the Fed hopes to encourage borrowing and economic growth without reigniting high inflation. This approach, if effective, could set the stage for mortgage rates to gradually decline over the next year.

2. Job Growth in the Economy

Another significant factor for the Fed is the pace of job growth. When the job market is strong, with employers adding many new positions, it indicates a robust economy. However, if job growth is too rapid, it can also lead to higher inflation, as increased employment often leads to more spending.

Recently, we’ve seen a slight slowdown in job creation, with fewer positions being added to the economy each month. According to a recent report from Reuters:

“Any doubts the Federal Reserve will go ahead with an interest-rate cut fell away on Friday after a government report showed U.S. employers added fewer workers in October than in any month since December 2020.”

This trend suggests that the job market is gradually cooling, which is what the Fed wants to see as it considers lowering rates. Slower job growth without high unemployment is a sign of a balanced economy, one where inflation might continue to ease, paving the way for lower mortgage rates.

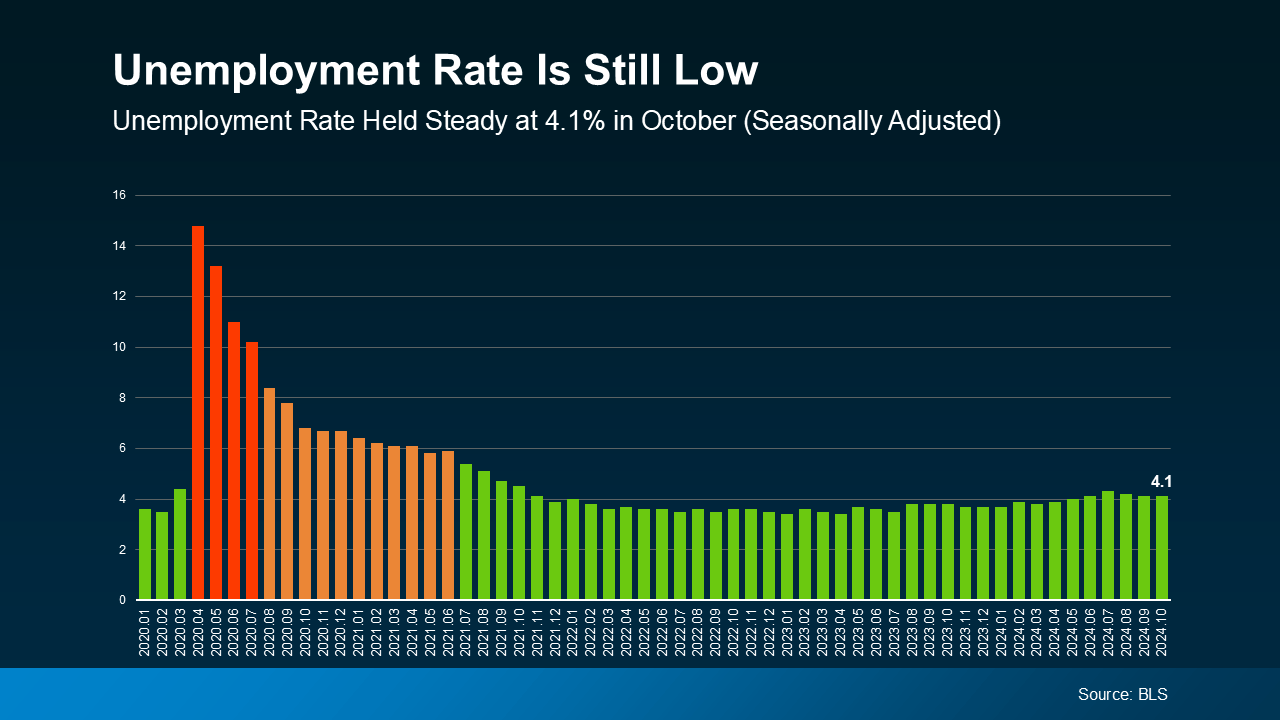

3. The Unemployment Rate

The unemployment rate measures how many people who want jobs are unable to find them. A low unemployment rate generally means that most people are working, which is a good sign for the economy. However, very low unemployment can also contribute to inflation, as more employed people often lead to increased spending.

Right now, the unemployment rate is around 4.1%, which many economists consider close to “full employment.” This is a favorable indicator for the Fed because it suggests a balanced labor market. If the unemployment rate stays around this level while job growth slows, the Fed will likely feel more comfortable reducing rates.

What Does This Mean for Mortgage Rates?

With the Fed potentially cutting the Federal Funds Rate, you might wonder if mortgage rates will drop immediately. However, it’s important to remember that mortgage rates don’t directly follow the Fed’s rate cuts. Mortgage rates are influenced by other factors, including inflation expectations, investor demand for bonds, and global economic conditions.

Still, if the Fed continues to lower the Federal Funds Rate over the next year, it could create an environment where mortgage rates trend downward. This process, however, is gradual. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

“Rates have shown considerable volatility lately, and may continue to do so . . . Overall, we still expect a downward long-term mortgage rate trend.”

What to Expect Moving Forward

Economic data and market conditions are always shifting, so it’s essential to stay updated. Even if the Fed lowers rates this week, mortgage rates might not respond immediately. We’re likely to see a gradual decline in mortgage rates over 2024 and into 2025, depending on how these economic indicators behave.

Ralph McLaughlin, Senior Economist at Realtor.com, sums up the situation:

“The trajectory of rates over the coming months will be largely dependent on three key factors: (1) the performance of the labor market, (2) the outcome of the presidential election, and (3) any possible reemergence of inflationary pressure.”

In other words, while we’re heading in the right direction for potentially lower rates, the journey won’t be a straight line. The Fed will continue adjusting based on economic data, and we can expect some rate volatility along the way.

Bottom Line: Partner with a Pro to Navigate Market Changes

The housing market is undeniably complex, especially when the Fed’s actions and economic factors play such a crucial role. If you’re thinking about buying or selling, don’t navigate this alone. Partner with an experienced real estate agent who understands the latest trends and can help you interpret what these shifts mean for your goals.

Whether rates are rising, holding steady, or gradually falling, a great agent will provide you with up-to-date insights and strategies tailored to your situation. By staying informed and working with a trusted advisor, you can make the most of your real estate journey with confidence.

Ready to explore your options in today’s market? Let’s connect and turn uncertainty into an advantage, guiding you every step of the way. realtor, best agent, real estate, Southlake, Keller, Haslet, home buyer, home seller, home value, Trophy Club, Fort Worth, new home, house, home selling, seller tips, 4wheeltorhomes, 4wheeltor, Crystal Zschirnt, Westlake, Roanoke, Justin, Northlake, Flower Mound, Argyle, Texas

💾 𝗡𝗼𝘄 | 𝗙𝗼𝗹𝗹𝗼𝘄

𝗳𝗼𝗿 𝗠𝗼𝗿𝗲 | 𝗦𝗵𝗮𝗿𝗲

𝘁𝗵𝗲 𝗞𝗻𝗼𝘄𝗹𝗲𝗱𝗴𝗲

𝗖𝗿𝘆𝘀𝘁𝗮𝗹 𝗭𝘀𝗰𝗵𝗶𝗿𝗻𝘁 | 𝗣𝗿𝗲𝗺𝗶𝗲𝗿 𝗔𝗴𝗲𝗻𝘁 | 𝟴𝟭𝟳-𝟴𝟳𝟰-𝟳𝟲𝟳𝟳 | 𝗖𝗭@𝗥𝗲𝗱𝗳𝗶𝗻.𝗰𝗼𝗺

#DFWRealEstate #DFWRedfin #DFWEliteRealty #DFWHomes #4wheeltor #4wheeltorhomes

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment