With home prices climbing and mortgage rates fluctuating, the road to homeownership can feel daunting. But there’s good news: the number of down payment assistance (DPA) programs has grown significantly in recent years, opening up more opportunities for buyers to achieve their dream of owning a home. If you’re navigating today’s housing market, these programs could be a game-changer. Let’s dive into what this means for you and how you can take advantage of these resources.

More Programs, More Opportunities

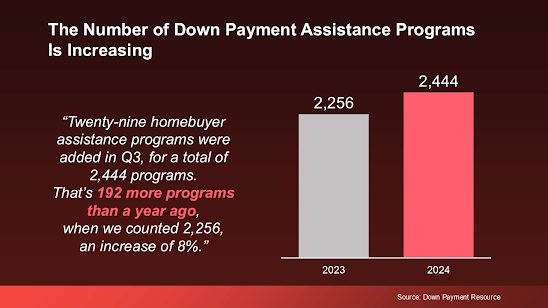

The rise in down payment assistance programs isn’t just a small-scale improvement—it’s a significant shift. According to Down Payment Resource, the number of DPA programs has surged over the past year, with new initiatives added to help make homeownership more accessible. This increase means there’s now a higher chance that one of these programs could be a perfect fit for your needs.

And these aren’t minor benefits. The average DPA program offers around $17,000 in assistance, according to Rob Chrane, Founder and CEO of Down Payment Resource. Think about how much that could help you on your journey to homeownership. For many, that’s not just a helping hand—it’s the boost they need to overcome the most significant barrier to buying a home.

Who Benefits from Down Payment Assistance?

While many DPA programs are tailored for first-time or first-generation homebuyers, recent growth in these programs means their benefits extend even further. Many initiatives now support a broader range of buyers, including those purchasing manufactured homes or multi-family properties. This increased flexibility means more people and home types qualify for assistance, making it easier than ever to find a program that aligns with your homeownership goals.

Even if you don’t fit the typical profile of a first-time buyer, there’s a good chance you could still qualify for some form of assistance. Programs have expanded to include affordable housing initiatives, ensuring that as many people as possible can access the dream of owning a home.

The Impact of $17,000 on Your Homebuying Journey

Let’s break down how much of a difference $17,000 in assistance could make.

- Closing the Gap on a Down Payment: With home prices rising, saving for a down payment can feel like an uphill battle. DPA funds can cover a significant portion of this cost, helping you reach your savings goal faster.

- Reducing Your Monthly Payment: A larger down payment reduces your loan amount, which means smaller monthly mortgage payments. Over time, this can save you thousands of dollars.

- Covering Additional Costs: Beyond the down payment, buying a home comes with closing costs, inspection fees, and more. Down payment assistance can help ease these financial burdens, giving you more breathing room as you transition into homeownership.

How to Find the Right DPA Program for You

With so many programs available, it can feel overwhelming to find the right one. That’s where partnering with a real estate agent and a trusted loan officer comes in. These professionals have in-depth knowledge of local programs and can help you navigate the options to find the best fit for your situation.

According to The Mortgage Reports, “The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Here’s how working with experts can benefit you:

- They’ll identify programs tailored to your financial situation and homebuying goals.

- They can guide you through the application process, ensuring you don’t miss important deadlines or requirements.

- They’ll help you understand how DPA funds work alongside other financial tools, like first-time homebuyer tax credits or special loan programs.

How Down Payment Assistance Can Help You Buy Now

In today’s market, affordability challenges have made it harder for many buyers to take the leap into homeownership. However, the growing number of DPA programs means more people can access the funds they need to get started. Whether you’re dreaming of buying your first home, upgrading to something larger, or downsizing, these programs offer a valuable resource to make your goals a reality.

Bottom Line

Don’t let rising prices and mortgage rates hold you back from pursuing your dream of owning a home. With more down payment assistance programs available than ever, now is the perfect time to explore your options. Whether you’re looking for help covering your down payment or additional costs, these programs can make all the difference.

Let’s work together to ensure you have the right team of experts to guide you through the process. From identifying the best DPA program for your needs to navigating the homebuying journey, we’re here to help every step of the way. Homeownership might be closer than you think! realtor, best agent, real estate, Southlake, Keller, Haslet, home buyer, home seller, home value, Trophy Club, Fort Worth, new home, house, home selling, seller tips, 4wheeltorhomes, 4wheeltor, Crystal Zschirnt, Westlake, Roanoke, Justin, Northlake, Flower Mound, Argyle, Texas

💾 𝗡𝗼𝘄 | 𝗙𝗼𝗹𝗹𝗼𝘄

𝗳𝗼𝗿 𝗠𝗼𝗿𝗲 | 𝗦𝗵𝗮𝗿𝗲

𝘁𝗵𝗲 𝗞𝗻𝗼𝘄𝗹𝗲𝗱𝗴𝗲

𝗖𝗿𝘆𝘀𝘁𝗮𝗹 𝗭𝘀𝗰𝗵𝗶𝗿𝗻𝘁 | Premier REALTOR® | 𝟴𝟭𝟳-𝟴𝟳𝟰-𝟳𝟲𝟳𝟳 | 𝗖𝗭@𝗥𝗲𝗱𝗳𝗶𝗻.𝗰𝗼𝗺

#DFWRealEstate #DFWRedfin #DFWEliteRealty #DFWHomes #4wheeltor #4wheeltorhomes

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment